With MyFedLoan it is important to remember while dealing with them that you will probably deal with an employee from a call center who does not have any interest in the well-being of your financial security. That is why you need to get more information about your student loan, know your options and direct the conversation in the right direction.

In MyFedLoan Login Account, federal Student loans have two most common forms: Direct loans and Federal loans for family education. Both types of loans are eligible for one or more payment plans related to income:

Official Login or Official Support

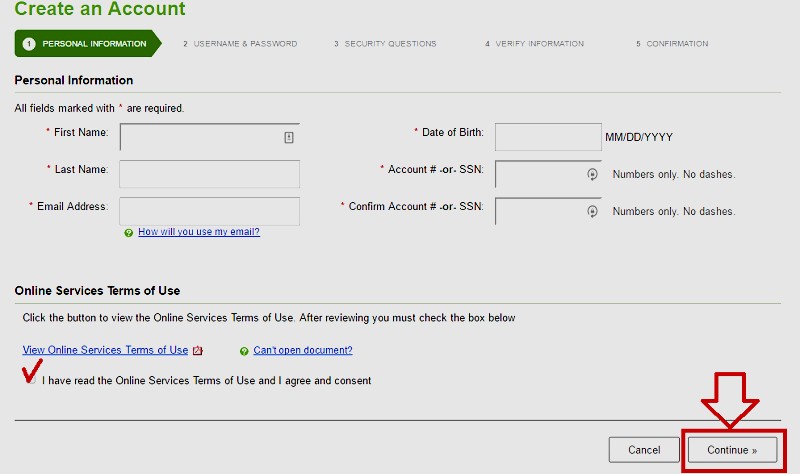

MyFedLoan – Login to FedLoan Servicing Account

Please follow the below-given steps so that you can easily log in to MyFedLoan and can directly access FedLoan Servicing Portal

- Visit the official website at www.myfedloan.org

- You can see the “Account Access” section on the right-hand side, click on “Sign In Now”

- Now enter your username and password and click on “Sign In”

So we think that it was easy to get access to the MyFedLoan account.

MyFedLoan Payment Options:

Once you are logged in to FedLoan Servicing account, you can see what type of federal student loan you have, what is the interest rate on those loans, the repayment amount, etc.

- Revised pay as you earn a plan

- Pay as you earn a plan

- The repayment plan for new borrowers

- Revenue-based repayment plan

- Income contingent repayment

In MyFedLoan, each of these plans aims to link your monthly payment with your income and the size of your family. In summary, these plans offer an affordable payment option during the life of the loan.

Along with these IDR plans, there is a standard repayment plan, a graduated repayment plan, and an income-sensitive repayment plan.

| Official Name | https://myfedloan.org/ |

|---|---|

| Country | United States |

| Languages | English |

| Sector | Finance |

MyFedLoan Benefits

If you are an employee of a qualified nonprofit organization or a full-time volunteer with AmeriCorps or the Peace Corps, you are eligible for forgiveness on your direct loans after 120 qualifying payments on an eligible payment plan.

- FedLoan Servicing gives you the opportunity to qualify for loan forgiveness.

- Get Teacher Loan Forgiveness Benefits.

- The public service loan forgiveness

- You also control the discharging or cancellation of your loan.

- Get your free credit score.

- If you wish to make payments online to authorizing someone to negotiate your account on your behalf.

Reimbursement Strategy of My Fed Loan

The reimbursement system helps you manage the understudy advances efficiently and organizing reimbursement design activities. Before you can execute the FedLoan payment system, you must understand your payment terms.

Follow these suggestions to simplify your process such as advance payment, consolidation, additional financing, immediate interest payments. As explained in the previous procedures, you can pay off your understudy advances using MyFedLoan.

How to get a student loan help with MyFedLoan?

Working with MyFedLoan can help you keep your student loans on track. If you need help with your payments, contact your service provider immediately to find out what options are available. The most popular payment methods are:

- Standard payment plans provide a fixed monthly payment amount during the loan period

- Graduated Repayment Plans begin low but gradually increase every year

- Payment plans based on income are based on your debt and your annual income.

- For instance, Pay as You Earn option takes your family size and income into consideration for the less monthly payment amount.

- Most of these plans are eligible for Student loan forgiveness after 20 to 25 years.

- Well, difficulties are part and parcels of life. In case you are facing any temporary problems or you are not able to pay your loan debt, FedLoan provides deferments and forbearances for eligible borrowers. This option just keeps you in good standing.

Get MyFedLoan Professional Help

If you have problems with FedLoan and seek professional help, there are many ways you can get guidance with your student loans.

No matter how irritating it is, contact your lender first (FedLoan). Agreed, they may be difficult to deal with, but the government pays them to help you out.

Remember that you can do many other things with StudentLoans.gov.

This includes securing your loans and applying income-based payment plans.

You can also pay a third party company for assistance. Be sure with the fact that what will you get after doing this.

Get Financial Assistance with FedLoan Servicing

If you don’t know how to begin or how to move ahead, you should hire a CFA to guide you with your student loans. We suggest the Student Loan Planner from FedLoan Servicing to assist you to prepare a solid monetary plan for your student loan debt. The student loan planner can be found here.

Only if possible, consider refinancing or consolidating a lender’s student loan as a FedLoan service. You can do it in different ways, but I recommend beginning with Credible. Credible is a boon for student loans.

You just need to fill a single form after which you will receive multiple offers from multiple lenders on a single dashboard. Credible is likely to only work with high-quality private lenders, with whom you can work much more easily as compared to FedLoan.

Conclusion

If you are having trouble logging into the FedLoan account, we suggest that you read the FAQ page before contacting a FedLoan representative. In MyFedLoan you can see all details about billing, security, loans, payments, etc.